We take a look at the pros and cons of paying piecemeal, and how Croptracker can make your payroll decisions faster and easier.

Throughout the US, Canada, and New Zealand, work crews for fruit and vegetable farming are often paid by piece rate. While complying with minimum wage laws, this compensation approach can be used to pay workers in lieu of a more traditional, hourly wage system. This method aims to counter mounting labor expenses, which can be as high as sixty percent of crop production costs. No matter how you choose to format paying for labor, you can simplify your process by managing everything with Croptracker.

Piece rate and minimum wage compliance

Implementing a piece rate pay structure means that employees are paid to complete a particular task by every ‘unit’ created or harvested – so a worker is compensated by individual output, like how much fruit is picked per day. Workers must not be paid less than minimum wage after computation of the per-hour price, and employers must also comply with overtime compensation and make sure they keep accurate records to abide by local law. To comply with the minimum wage requirement, an employer would have to make a specific calculation. First, the employer must track the total number of hours worked. Then, the employer must divide the worker’s piece-rate compensation by the total number of hours worked. This will give a theoretical per-hour wage, which will have to be compared against the minimum wage. A piece-rate compensation must not be any less than the legal minimum wage in the area.

Say a worker makes $480 over the course of a 40-hour work week, by way of piece rate. The operation they work for equates this amout to a $12 per-hour wage. If this particular job took place in Seattle, Washington, where the minimum wage stands at $15, the deficit between this standard and the earned income must be paid out. Doing this satisfies the rule of a piece-rate wage not going below the regional minimum wage, and the worker would receive $600. A calculation such as this one must be used in each project a worker completes, to ensure legal compliance. In Croptracker, minimum wage compensations are automatically calculated for you.

Complying with Overtime

An employer must always track the number of hours their employees work. Once an employee works over 40 hours in a single week, they must be awarded overtime pay. Such a calculation goes as follows: first, the employer must calculate the worker’s average hourly wage throughout the week, including overtime. Afterwards, the rate of overtime pay comes from multiplying overtime hours by 1.5 times the base compensation. If an employee works for 50 hours in a week, for a total of $750 in piece-rate compensation. The hourly wage (following the calculation we previously showed) would be $750/50 hours = $15 per hour. Because a work-week maximum would be 40 hours, there would be 10 hours of overtime.

In this case, the overtime pay would have to be calculated like this:

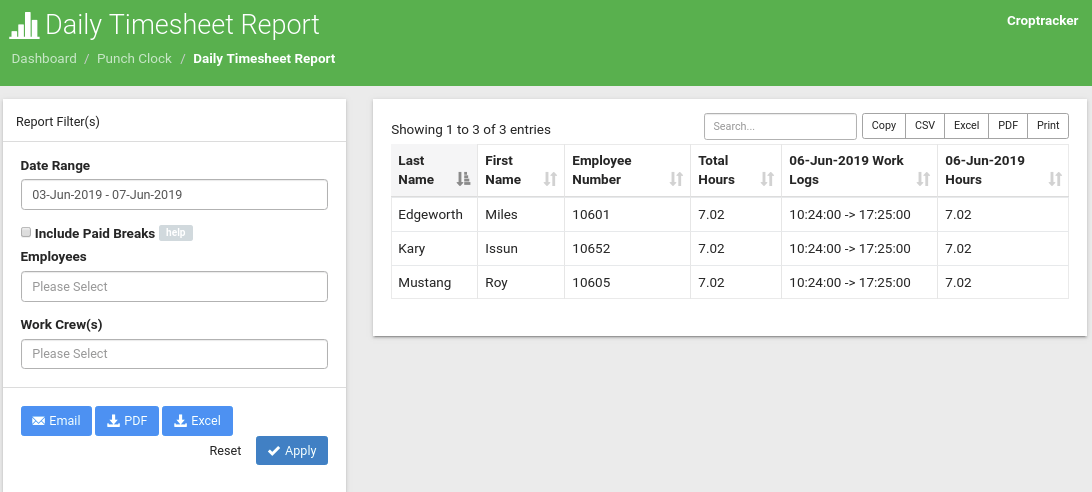

$15 (base pay) x 1.5 (overtime rate) X 10 hours of overtime in the week = $225 overtime pay that must be awarded. Using Croptracker’s Daily Timesheet Report, weekly hours are summarized by employee and totalled for a one click solution to tracking overtime hours.

The California Exception

California, in the United States, is a particular case, and a sort of exception. In that state, employees must be compensated for downtime, too. It is not enough to comply with the aforementioned scenarios and pay piece rate. Employers must account for rest and recovery hours, and other non-productive hours. Each must be compensated in addition to the lawfully calculated piece-rate.

In respects to rest, employers must provide 10 minutes of rest time for every four hours of work. Recovery time is important for preventing heat afflictions. Compensation for rest must be the highest of either (a) the average hourly rate calculated by the division of the total compensation of the work week (without rest or recovery compensation) by the total hours worked during the week (without breaks) or (b) the minimum wage applicable in the area.

In cases such as California, the legal requirement to accommodate for rest may incite paying a lower piece rate wage altogether. Using a flat hourly wage in this situation may be more prudent.

Pros and cons of piece rate

The disadvantages to paying piece rate center around the risk of hindered production. In new projects, it may be difficult to determine how much product is expected to be gathered, making it difficult to calculate the correct piece-rate that both benefits the employer and motivates the worker. The incentives that piece-rate imply can lead workers to generate results at maximum efficiency, even when they are perhaps not able to. Working too fast may lead to injury.

Though the emphasis in harvesting for fresh markets is on quality, utilizing a piece rate pay structure can skew incentive toward efficiency and quantity. This can cause quality to suffer. The idea, therefore, should be to have workers learn exactly what they are to be doing and then to execute in the most efficient manner possible. It is not, however, to have workers forgo quality and correct processes in the name of speed.

Advantages of paying piece rate?

As much as there are disadvantages to piece rate, there are several strong advantages too. Quite simply, it is more time-efficient. Since the employee is being paid for his output, the worker is encouraged to manage time better, be more productive and finish faster. Less supervision is possible this way. When paid per piece, a worker develops the most efficient way of working. Employers get what they pay for, and diligent employees will earn more, either by completing more ‘units’ of work or by finishing the job fast and moving on to other things. In terms of cost accountability, it is easier to calculate the cost per unit.

Another advantage of piece-rate is that an employee’s performance may be judged better, making for fairer and simpler dismissals. Imagine for instance that a worker is paid per bucket of fruit picked; it will be easy to ascertain whether the employee is performing well or not. The worker may be dismissed based on a verifiable poor performance/rate of performance.

When is it best to use piece-rate?

As can be seen from the advantages and disadvantages, there are specific times and projects when piece rate simply makes more sense than standard by-the-hour compensations which may mean rising costs. One scenario would be when there is a large-scale project with a lot of repetitive tasks. Fruit picking is also an instance where paying piece rate will probably increase employee productivity. Piece rate makes sense when the worker already knows the craft or duty they will have to perform, or in situations where there are no security hazards that may be perilous to workers working very fast.

In Croptracker, piece rates can easily be associated with your harvest or field pack items such as bins or baskets, or even with production practices such as number of trees pruned or acres mowed. Farm employers are well advised to view a piece-rate scenario as one in which they figure out how much they are saving per acre, rather than focusing on how much employees make when their earnings are translated into an hourly wage.

Finally, attention should be given to contemporary legal developments. The Seattle Supreme Court, for example, recently found that tasks related to piece rate workers, such as unloading equipment at the end of the workday or the travel between each field, picking up fruit, should be tracked and compensated too, this time by the hour. Legal developments such as this one may alter piece rate compensation altogether in the future.

It's easy to see how some farming operations would benefit from a piece rate compensation scheme and how such a scheme could increase productivity. In spite of legal innovations and enmity from certain quarters, piece rate payment strategies do not seem to be disappearing. In fact, as minimum wages increase, perhaps there will be more sense in using piece rate with its enhanced productivity and more motivated workers.

Whether you prefer to pay piecemeal or hourly, Croptracker farm management software can provide solutions, and eliminate paperwork in your operation’s payroll department. Croptracker has a solution for your operation, from large to small. Contact us today to see how we can help your organization simplify your payroll process, piece meal or otherwise.

Interested in learning more about Croptracker? Learn more about our Farm Management Software, or book a demonstration to schedule a meeting with our product experts.

And as always, if you're ever stuck, never hesitate to e-mail us at support@croptracker.com or Live Chat with us by clicking the green speech bubble ![]() in your bottom right-hand corner. We're always happy to help you make the most of Croptracker to make your farm more efficient, safer, and more profitable!

in your bottom right-hand corner. We're always happy to help you make the most of Croptracker to make your farm more efficient, safer, and more profitable!